bet168 S&P Global: PH growth of 4.8% by 2035 to help int’l development

Updated:2024-10-22 11:38 Views:146

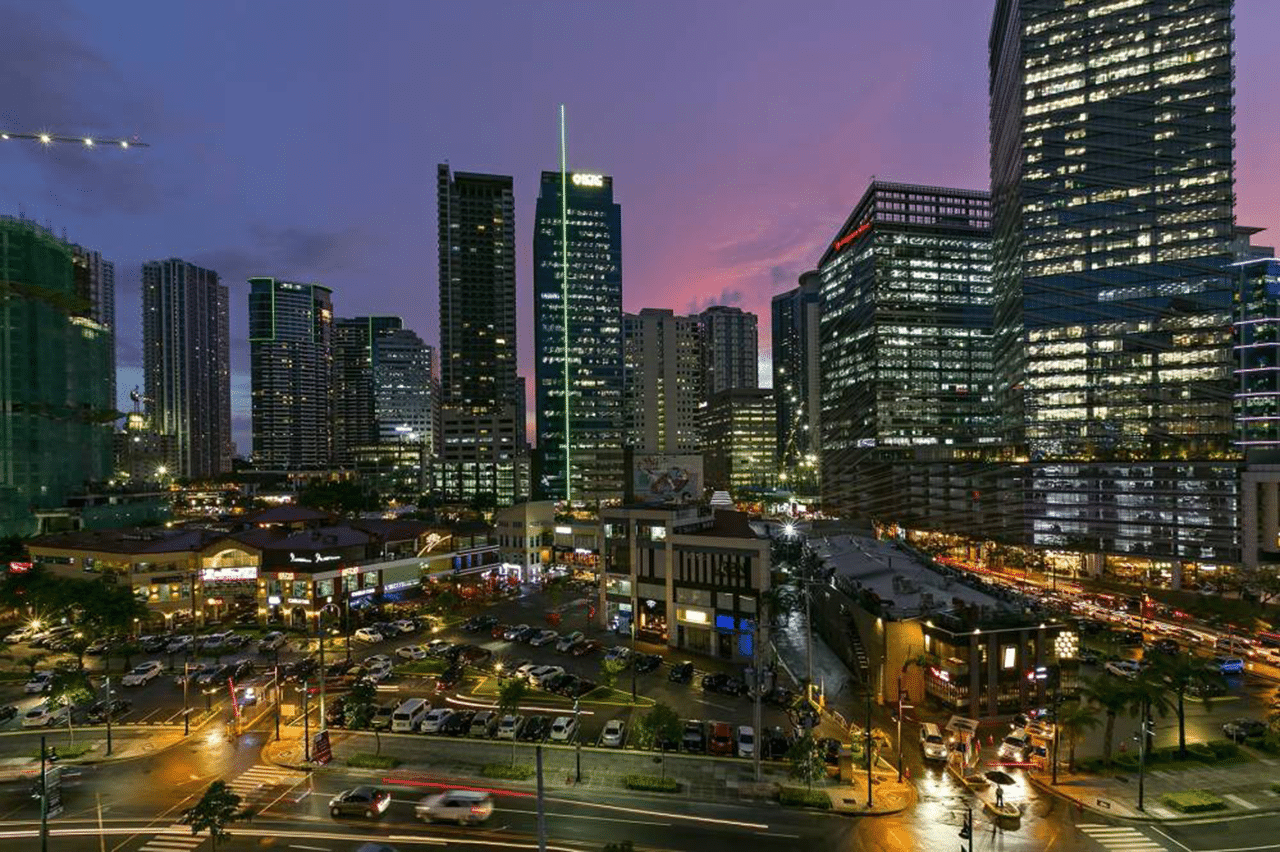

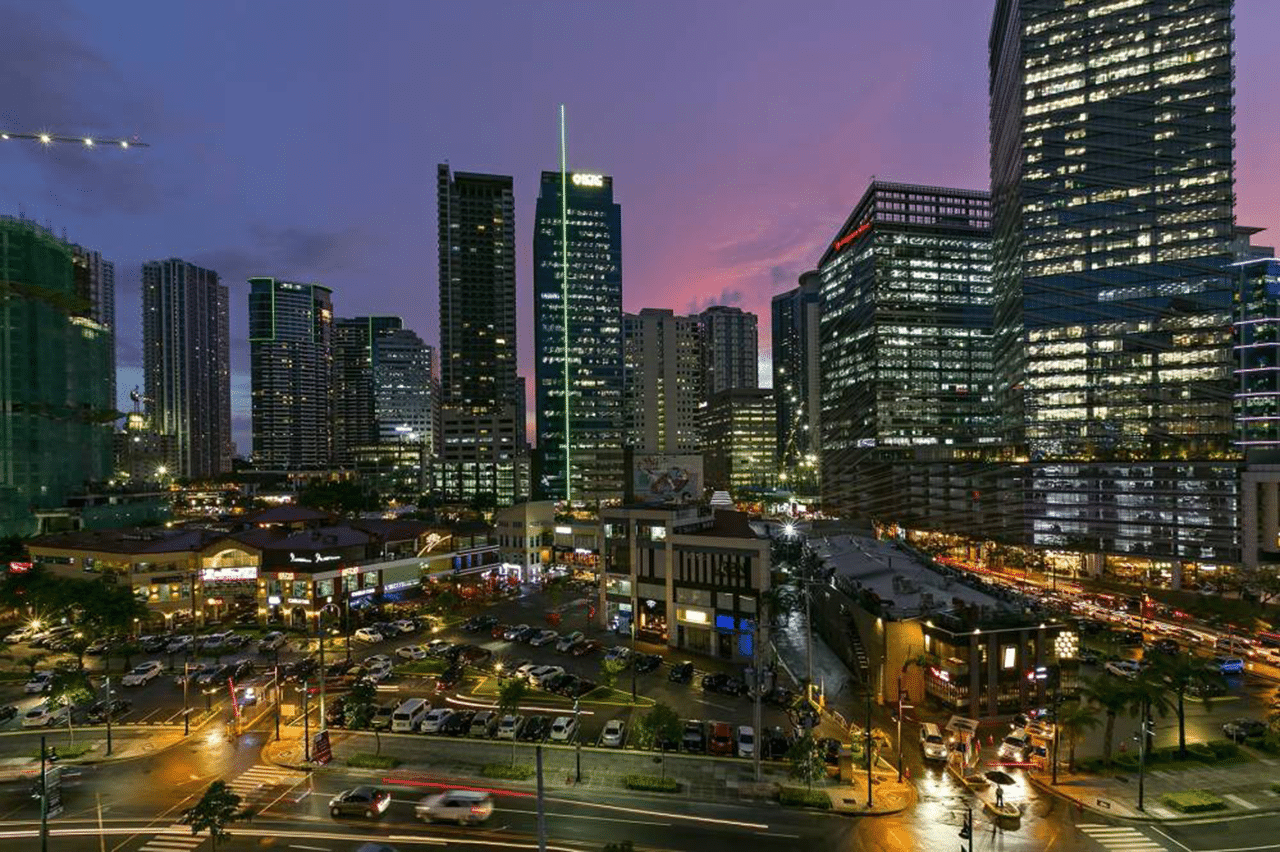

Bonifacio Global City | PHOTO: BGC.COM.PH

The Philippines is seen to be one of the emerging economies in Asia-Pacific to drive global economic growth in the next 10 years, S&P Global said in a report on Thursday.

The S&P Global defines “emerging markets” as countries that have been or are transitioning toward middle- income levels, with good access to global capital markets, deepening domestic capital markets, and global economic relevance based on economic size, population and share in global trade.

Article continues after this advertisementWith an average growth rate of 4.8 percent projected by 2035, the Philippines ranks third among the fastest-growing economies, behind Vietnam at 6.2 percent and India at 5.9 percent. Together with its regional neighbors, the country is also expected to contribute approximately 65 percent of global economic growth.

FEATURED STORIES BUSINESS National ID gives more Filipinos ‘face value BUSINESS BIZ BUZZ: Unwinding Gogoro … quietly BUSINESS Polvoron maker seeks P500 million capital for expansion“Emerging markets will play a crucial role in shaping the global economy over the next decade, averaging 4.06 percent Gross Domestic Product (GDP) growth through 2035, compared with 1.59 percent for advanced economies,” the report added.

READ: PH economy grew 6.3% in Q2, outpacing most Asian nations

Article continues after this advertisementIn the second quarter, the Philippines expanded by 6.3 percent buoyed by increased state spending and strong investments, marking the fastest expansion seen in four quarters.

Article continues after this advertisementThis brought average first semester GDP growth to six percent, well within the government’s six- to seven-percent target for the year.

Article continues after this advertisementIn order for the emerging country to sustain its growth, S&P noted that they need to boost productivity more than developed countries. It added that emerging markets that can take advantage of global trends, like the shift to renewable energy and changes in supply chains, are in a strong position to improve productivity.

“Indonesia, Chile, and the Philippines, among others, are well suited to supply metals and minerals required for the energy transition,” S&P said.

Article continues after this advertisementREAD: PH is in ‘prime position’ to supply in-demand critical minerals – Marcos

While the debt watcher expected that majority of larger emerging markets to fail in reducing its debt to pre-pandemic levels in the next decade, it projected the Philippines to lower its debt-to-GDP ratio by 2035.

“Of the emerging markets with GDP over $300 billion, only Chile, India, Indonesia and the Philippines are projected to lower their debt-to-GDP ratio during this period,” it added.

The government set the debt-to-GDP ratio at 60.6 percent this year, slightly above the 60 percent that lenders deem manageable for developing economies. For the second quarter, the debt-to-GDP ratio placed at 60.9 percent.

Moreover, the debt watcher believed that the role of the emerging countries in the global economy will continue to rise in the coming year as their share of the global economic output increases.

Subscribe to our daily newsletter

Howeverbet168, it stressed that in order for these countries to maintain their appeal for investments, they need to meet economic expectations of their populations which helps ensure social stability and policies.

READ NEXT China posts slowest growth in over a year as property issues hang Gold breaks above $2,700 to record high EDITORS' PICK NBA: Nuggets give Aaron Gordon 4-year, $133M extension PVL: Alohi Robins-Hardy set for PH return, joins Farm Fresh ASF vaccination expands to bigger piggeries QC Mayor Belmonte highlights social services in State of City Address UPDATES: 2025 elections precampaign stories INQside Look with senatorial aspirant Tito Sotto MOST READ SC issues TRO vs Comelec resolution on dismissed public officials Garcia to ask PNP for list of private armed groups before 2025 polls LIVE UPDATES: Tropical Storm Kristine AFP reprimands cadet who asked for Marcos wrist watch View comments